OFP Strategy 2018-2022

OPPORTUNITIES FIFE PARTNERSHIP: STRATEGY REFRESH AND OUTLINE

ACTION PLAN & RISK REGISTER

1.0 CONTEXT

The Opportunities Fife Partnership (OFP) was created and a Strategy developed in 2010. In 2013, progress on the implementation of the Strategy was reviewed and a number of measures adopted to take account of the review recommendations. However, the operating context within which OFP works has continued to change, necessitating a rethink around strategic direction and priority actions to realise OFP’s mission and objectives.

2.0 KEY CHALLENGES

2.1 Changing Economy and Labour Market

- In overall numerical terms, employment has recovered from the darkest days of the 2008 recession. However, some of the recovery has centred on new forms of self-employment where employers have switched out of traditional employment contracts to reduce labour costs and avoid paying national insurance contributions. Part time and temporary contracts, including zero hours work, have also expanded. None of these works well for people trying to come off benefits.

- Although employment levels have expanded, real earnings have not, and labour market analysts do not see this changing much in the foreseeable future. Again, this makes work a less rewarding outcome for unemployed people, particularly when combined with the deteriorating quality of work on offer.

- However, in more recent times, employers have begun to complain of recruitment difficulties across arrange of occupations and sectors. This creates an opportunity for organisations helping the unemployed back into work and an onus on skills providers to make sure they are continuing to train for the skills in demand.

2.2 Welfare System

- Big cuts in welfare spending have been concentrated on out of work working age people as well, as those in work but receiving tax credits. This generates a greater need for employment and skills services that can move their customers into good quality and sustainable employment opportunities.

- The roll out of Universal Credit is intended in part to make work pay to a greater extent than previously. However, there appear still to be significant problems with the design detail which for many claimants will be a distraction from the efforts being made to get them into work.

2.3 National Employment Programmes

- The UK’s national employment programmes are no longer delivered in Scotland. From April 2018, a new Scottish devolved employment service – Fair

Start Scotland – comes into play. The focus of the new programme is on those further from the labour market, with a strong emphasis on people with

disability and health issues. It is also a voluntary programme which should make it easier for local employability partnerships to align and work with

the new programme. - The second major strand of the Scottish Governments approach to employability is to achieve greater alignment and integration of employability services with key complementary services such as education, health and criminal justice. This has provided fresh impetus to and more scope for local employability partnerships to make a significant contribution to joining up services at the local level.

2.4 Policy Developments

- With the publication of Scotland’s Economic Strategy in 2015, a much stronger and more explicit focus on inclusive growth emerged. Employment

and skills interventions are two of the key ways in which inclusive growth is delivered. Indeed, smartly designed skills interventions can promote

growth and inclusivity simultaneously. - The Fife Economic Strategy, published in 2017, is nested within Scotland’s Economic Strategy, and so inclusive growth features strongly with an expectation that the Opportunities Fife Partnership will be key in driving this.

2.5 Declining Resources

- While some of the above developments call for and create opportunities for a more effective employability effort, the resource base has been

declining across Scotland. Local authority funding is under persistent pressure, and employability and economic development are not statutory service

areas. At the Scottish level, the money devolved for the new employment service is well below the funding for the previous UK programmes because

of big cuts to DWP programme budgets in the transition from Work Choice and Work Programme to the new Employment and Health Programme. - The implications are two-fold here. Through better intervention design and continuous improvement, local employability partnerships need to find

higher levels of effectiveness. Additionally, greater efforts need to be made to find this greater effectiveness through joining up more intelligently

with complementary service areas, such as health.

2.6 Uncertainty

- Uncertainty in the short to medium term now abounds due to Brexit. The near consensus is that ‘hard’ Brexit will impact negatively on trade, and so

also on employment levels. On the other hand, if there is corresponding fall in migration levels into low skilled jobs there may be increased

opportunities for those currently unemployed – but at the same time a threat that some of the employers offering these jobs will relocate or down

size. Finally, the threat of a ‘hard’ Brexit raises issues about the Structural Funds. Within these, ESF has been a major funder of employability services

in many localities across Scotland. Will the UK and/or the Scottish Government make good the loss of the 40% coming back from the EU? - In the medium to long term, automation will transform the nature and structure of employment. Clearly labour saving technologies have been

introduced over many centuries, and although employment has been transformed it has also grown massively. The new wave of automation will,

however, radically restructure employment, with many professional jobs certain to be effected. It is important to note that the American academics

who have led this work do not set out a timescale on the impacts, and do not assess what it means for overall employment levels. - All local partnerships can do in conditions of uncertainty is to keep scanning the changing environment to draw out local implications, and where

possible build significant flexibilities into what is funded and delivered so that speedy responses to changes can be introduced as they feed through.

2.7 Trends in Fife’s Labour Market

- Fife’s unemployment rate has been consistently higher than the Scottish Average over the last 10 years, in fact regularly 0.5% higher. At 0.6% in

2016, it is currently the largest gap since 2013. - Fife’s Youth Unemployment has been significantly higher than the Scottish Average over the last 10 years, at some points over 2% higher.

Substantial progress has been made to reduce youth employment in line with the Scottish Average, but the gap is still 1.1% which is the largest gap

since 2013. - Fife’s employment business base is largely made up of Micro and Small to Medium Enterprises.

- 96% of Fife’s 10,720 businesses have less than 49 employees

- 62% of Fife’s 10,720 businesses have 0-4 employees

- There are only 50 businesses in Fife with more than 250 employees

- 80% of Fife’s productivity comes from these larger companies - Fife’s main employment sectors are health (which includes social care and residential care), manufacturing and retail.

- Manufacturing as part of the wider sector ‘Energy and engineering/ manufacturing’ is seen to be particularly important for Fife and appears to be

bucking the national trend by sustaining and even increasing the number of jobs in the sector. - Over time, Fife is expected to see growth in professional and business services, and retail and tourism. However, it is at risk of further cuts to public

sector services employment. - Fife’s workforce is aging and by 2020, people over 50 years old will comprise almost one third of the working age population. This will have a

significant impact in terms of potential skills gaps, particularly in SME’s, when those workers chose to retire. Action is required to introduce

younger people into the workforce to learn from the older workers before these skills are lost from the local economy. - Key industry sectors for Fife and the surrounding City Region include:

- Construction and civil engineering.

- Energy and engineering/manufacturing.

- Food and drink

- Health and social care

- ICT and technology

- Tourism and hospitality

- Financial Services

- Creative Industries

- Retail

3.0 REFRESHING OFP’S STRATEGIC DIRECTION

The need to refresh OFP’s strategy is underlined by many of the changes in context set out briefly above. The partners came together in a workshop on 1st

August 2017 to discuss and agree the broad way forward, but also identify many of the actions which need to be implemented if the fundamental mission

of OFP is to be realised in a changed operating environment.

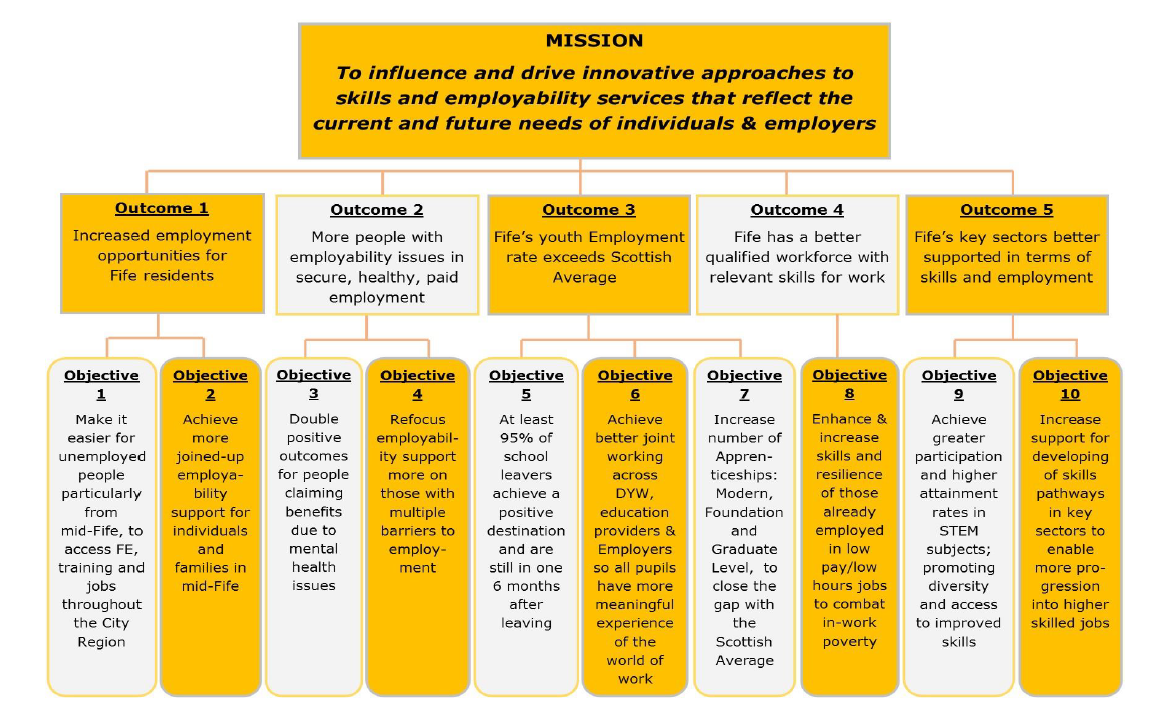

The key elements of the refreshed strategy are captured in the diagram below at three levels.

- A simplified mission which identifies to the two key customers for employment and skills services, but which is also quite explicit about the role of

OFP in the employment and skills system in terms of influencing and driving innovation. - A clear statement of the outcomes, drawn from the Fife Economic Strategy, which OFP will help to achieve.

- A set of 10 objectives that OFP will pursue to drive the realisation of its contribution to the strategic economic outcomes

4.0 IMPLEMENTING THE STRATEGY – OUR ACTION PLAN

The refreshed strategy sets out our direction of travel, but the critical question is: how do we get there?

The tables outlined in Appendix 1 summarises the key actions required to meet our ten objectives. The action plan breaks each down under a number of

headings.

- The objective to be pursued.

- The specific actions required to push towards the objectives, and the timing of these actions.

- The organisations responsible for implementing the actions.

- The additional organisations that need to be involved to support the implementation

- The KPIs which measure the delivery of the actions.

- The KPIs which capture intermediate outcomes being achieved, so we know to what extent our actions are bringing about the desired and required

changes

5.0 REVIEWING OUR EFFECTIVENESS

The evolution and effectiveness of implementing this strategy will be monitored through each of the four Delivery Groups and the OFP Executive Group,

who have key responsibilities for delivering different aspects of the strategy. In addition, however, the OFP will commit to an annual review which will

focus on:

- Progress in relation the KPIs capturing intermediate outcomes.

- Analysis of underperformance and identification of the actions required to rectify the position.

- Analysis of any significant changes in the broad operating environment and the implications for the strategy.

This rigorous annual review is a good discipline for OFP and should be scheduled at a time where it can influence any forward commissioning. It is our

intention to do this before March 2019, to reflect on the impact made by the delivery of the Fife Employability Pathway 2015-2019 and re-assess the

priorities for the 2019-2022 period.

6.0 RISK REGISTER

A register of OFP Risks has been created and will be monitored by the OFP Executive, and shared with the full Partnership. This is to ensure that the

Partnership continues to operate in an inclusive and meaningful way, with significant contribution being made by each of the Partners. The Risk Register is

outlined in Appendix 2.

Resources

Quick job search